These are the incentives PEZA provides its registered enterprises by virtue of The Special Economic Zone Act of 1995 (RA 7916) and the Corporate Recovery and Tax Incentives for Enterprises (CREATE) Act (RA 11534).

PEZA has the authority to approve or disapprove the grant of incentives to registered projects or activities with investment capital of P1 Billion and below.

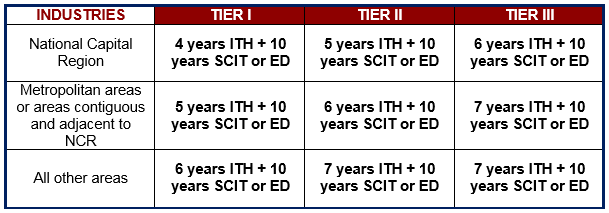

1. Export enterprises may be granted an Income Tax Holiday (ITH) of four (4) to seven (7) years depending on the location and industry priorities*

2. After ITH, export enterprises can avail a 5% Special Corporate Income Tax OR Enhanced Deductions for 10 years.

- Export companies availing the 5% SCIT based on gross income shall pay and remit as follows:

- 3% to be remitted to the National Government

- 2% to be remitted to the Treasury of the host Local Government Unit

*PERIOD OF AVAILMENT OF INCENTIVES BASED ON LOCATION AND INDUSTRY PRIORITIES

TIER I:

-

Activities that:

- Have high potential for job creation;

- Take place in sectors with market failures resulting in under provision of basic goods and services;

- Generate value creation through innovation, upgrading, or moving up the value chain;

- Provide essential support for sectors that are critical to industrial development; and

- Are emerging owing to potential comparative advantage

TIER II:

- Activities that produce supplies, parts and components and intermediate services that are not locally produced but are critical to industrial development and import-substituting activities including crude oil refining.

TIER III:

-

Activities shall include:

- Research and development resulting in demonstrably significant value-added, higher productivity, improved efficiency, breakthroughs in science and health, and high-paying jobs;

- Generation of new knowledge and intellectual property registered and/or licensed in the Philippines;

- Commercialization of patents, industrial designs, copyrights and utility models owned or co-owned by a registered business enterprise;

- Highly technical manufacturing; or

- Are critical to the structural transformation of the economy and require substantial catch-up efforts

SUNSET PROVISION: 10-year transition period for companies availing incentives prior to the passage of the CREATE Law

3. Tax-and-duty-free importation of capital equipment, raw materials, spare parts or accessories

4. VAT exemption on importation and VAT zero-rating on local purchases for goods and services directly or exclusively used in the registered project or activity of export enterprise for the period of registration of the said project or activity.

5. Domestic sales allowance of up to 30% of total sales

6. Exemption from payment of local government taxes and fees for the duration of the period of availment of the 5% SCIT incentive